Summary: Key Takeaways & Insights

Strong pricing signal sent to operators: Chairman and CEO Paal Kibsgaard provided the clearest indication yet that Schlumberger (SLB) has reached its limit on pricing concessions. Using levers that most supply chain companies simply do not have, SLB will seek to high-grade and where necessary re-negotiate contracts to ensure long-term financial viability.

- Price reductions based on margin erosion rather than structural cost savings can only serve as a temporary solution to the industry's many problems. Focus must remain on working together to make cost saving smart and sustainable.

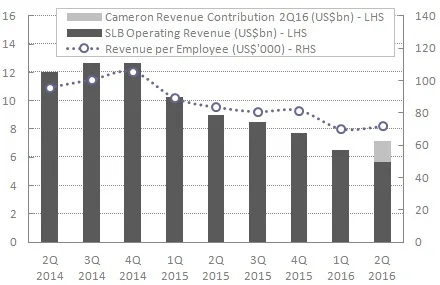

Emphasis on maintaining capability despite large headcount reductions in Q2: SLB's (including Cameron’s) workforce has been reduced by 35% since Q2 2014, including 16,000 job losses in Q2 2016 alone. As the company right-sizes itself, it continues to insist that capabilities are being maintained across all business lines and is in fact expanding through strategically-driven opportunistic M&A activity.

- Across the oilfield service sector, vast amounts of experience and expertise have been lost during this down cycle. This raises significant doubts around supply chain capability and capacity to deliver when activity recovers but suggests opportunity for those who have managed to retain core competencies and who have a well thought through mechanism to scale.

Please contact us if anything raises interest for you - we would be delighted to discuss further